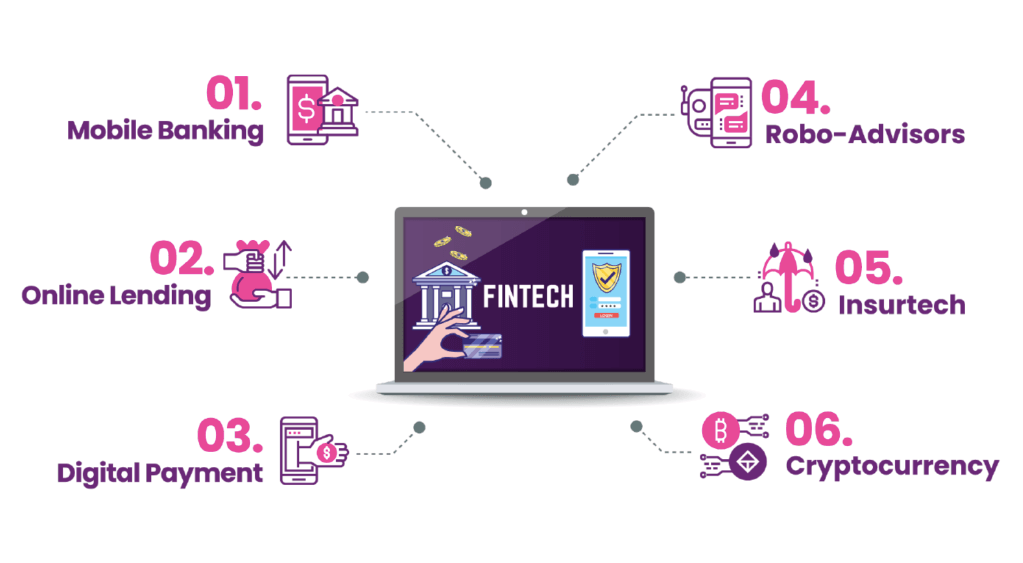

Building custom software solutions for fintech companies involves a clear, step-by-step approach.

This journey takes you from the initial idea all the way to a fully functioning product ready for the market.

Keep reading as we explore the detailed process of financial software custom development – from gathering initial requirements to the final product launch.

Understanding Initial Requirements And Market Research

Before you start coding, it’s important to build a strong foundation. This begins with understanding the project’s requirements and doing thorough market research.

Assessing the business needs

You can’t build a skyscraper without a blueprint. Similarly, any financial software project starts with understanding the specific needs of the fintech firm.

Is the goal to streamline transaction processes? Ensure better compliance? Or introduce new payment methods?

Identifying these goals will guide every next step.

- Hold regular meetings with stakeholders.

- Use surveys to gather input from potential users.

This phase should be exhaustive to ensure that all critical needs are captured.

Market analysis: Knowing the competition and audience

A comprehensive market analysis helps you identify opportunities, avoid pitfalls, and tailor your product to meet real needs.

Here’s what you need to do:

- Investigate competitors. Look at what your competitors are offering and their market strategies.

- Analyze strengths and weaknesses. Understand what they do well and where they fall short.

- Understand your audience. Find out what captures your target audience’s attention and keeps them loyal. This helps identify gaps in the market that your software can fill.

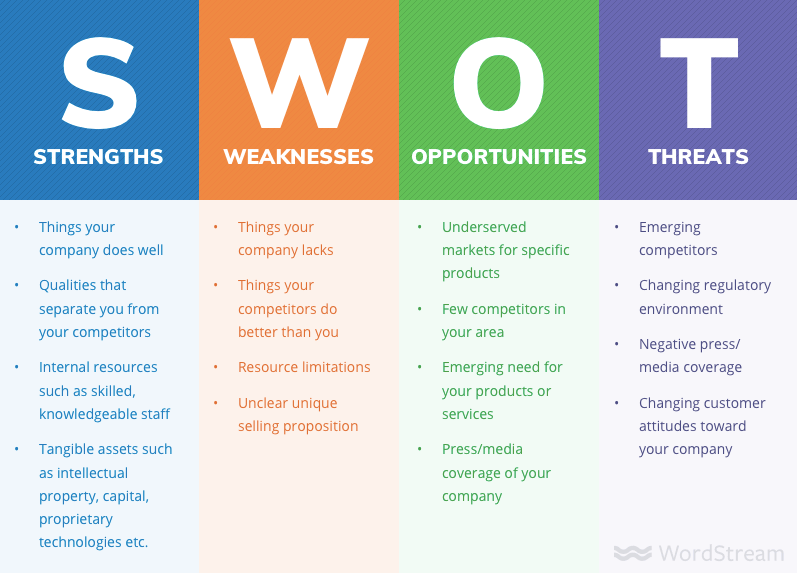

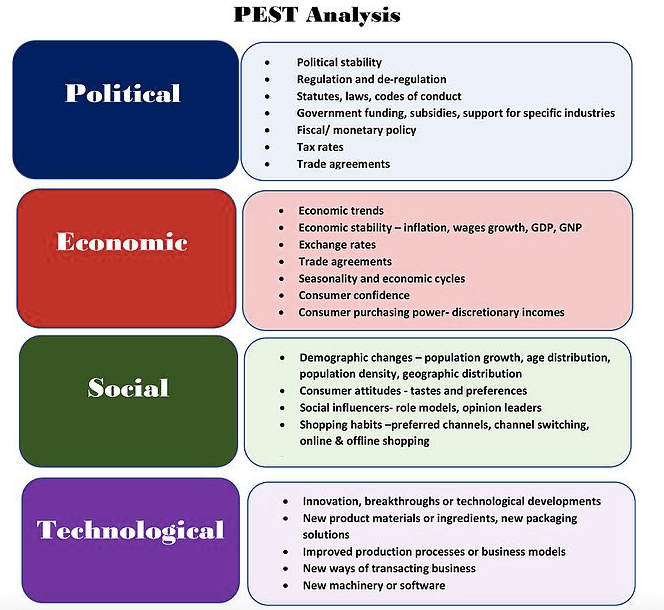

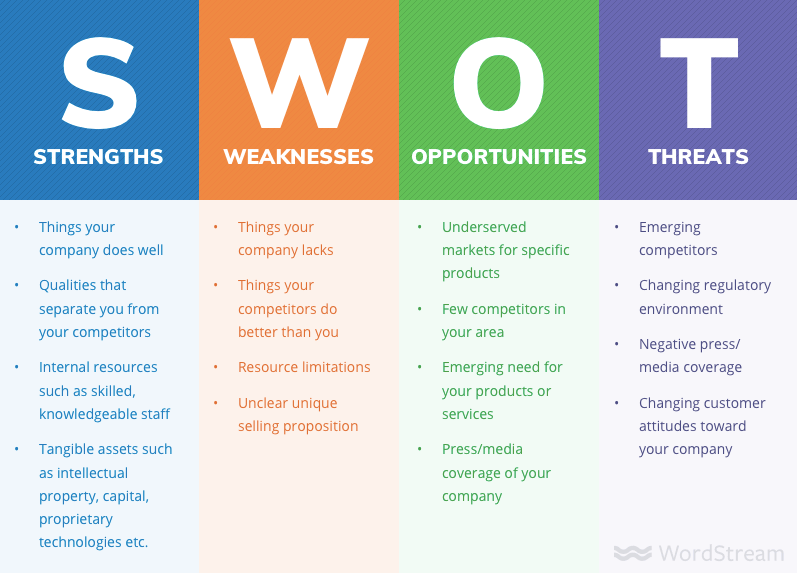

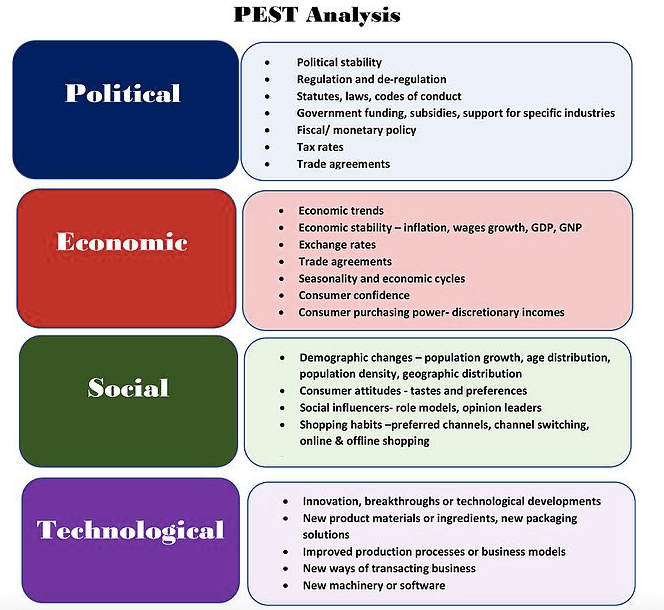

To gain a comprehensive understanding of your market position and external factors, consider using two powerful analytical tools: SWOT and PEST analyses.

SWOT analysis helps you evaluate your project’s internal Strengths and Weaknesses, as well as external Opportunities and Threats.

The PEST analysis, in turn, focuses on external macro-environmental factors that can impact your fintech software development and market success. It examines Political, Economic, Social, and Technological aspects of the business environment.

It’s not about copying what exists but seeing what’s out there and innovating beyond it.

Regulatory environment and compliance

Financial software must follow strict legal guidelines. Ignoring these can lead to heavy fines or even bans.

Make sure your solution follows all necessary laws and guidelines – like GDPR, PCI-DSS, and AML regulations, depending on where you operate. Integrate compliance into your development process right from the beginning.

Designing User-Centric Solutions

Let’s talk about design. Both the technical and visual aspects are essential when developing custom financial software.

User Experience (UX) design: Keeping it intuitive

User experience (UX) is important in any software, especially in fintech, where accuracy is essential.

A poor user experience can lead to costly mistakes for users and harm your brand’s reputation. Therefore, aim for an interface that is easy to navigate and understand while still offering powerful features.

- Wireframes: These basic visual guides show how different pages interact. Use them to draft the initial layout and structure of your software.

- Iterate with Feedback: Continuously improve your wireframes using feedback from real users or stakeholders.

- Mockups: These provide a more detailed and refined version of your wireframes, bringing you closer to the final product.

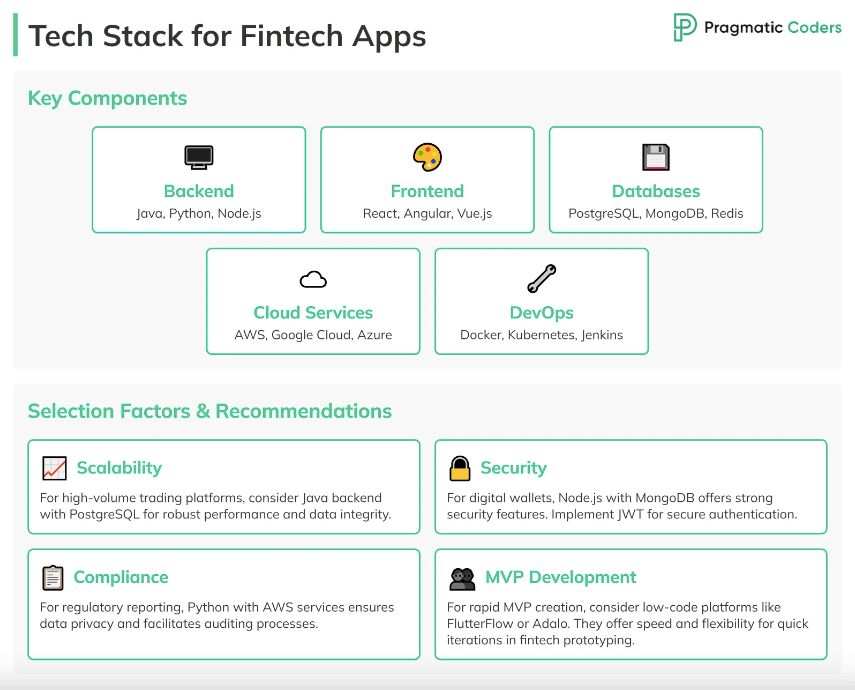

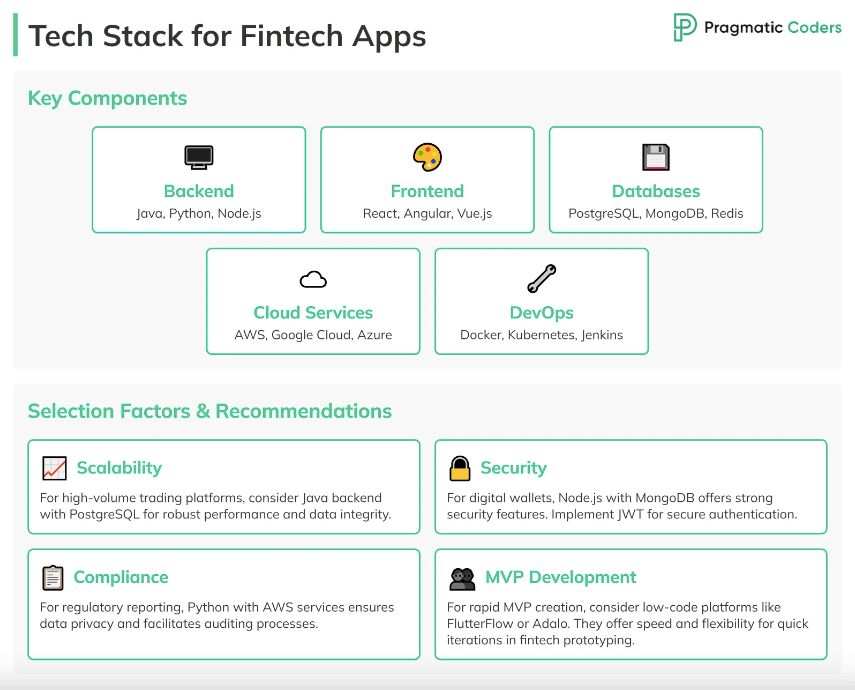

Technical architecture: Laying down the robust infrastructure

While user experience makes software enjoyable, a strong technical architecture ensures it works smoothly. You need a scalable backend that can handle more data and transactions as your business grows.

- Microservices Architecture: Choose this if you need flexibility and scalability.

- APIs (Application Programming Interfaces): These help integrate other services seamlessly via the API gateway platform to ensure high performance and security.

- Collaboration with DevOps: Work closely with DevOps teams for automated testing and continuous integration pipelines.

Security features: No room for compromise

Financial software deals with sensitive information like personal data, transaction details, and passwords. Security can’t be an afterthought; it must be built into every layer of your application.

- Encrypt data both when it’s stored and when it’s being transmitted.

- Use firewalls, intrusion detection systems, multi-factor authentication (MFA), and regular vulnerability assessments for layered security measures.

The goal is not just to meet regulatory requirements but also to build user confidence in the safety of their data.

Development Phases: Coding To Product Testing

We’ve covered the requirements and design – now it’s time for the actual creation, which involves coding, integration, and thorough testing.

Agile development: Flexible and efficient

Gone are the days of traditional development models; Agile is now the standard.

Agile development allows for iterative progress through various sprints, each focusing on building specific components or features.

- Daily Stand-ups: Hold these for regular updates among team members.

- Sprint Reviews and Retrospectives: Assess what went well and where you can improve.

Agile methods promote teamwork and help keep project timelines on track.

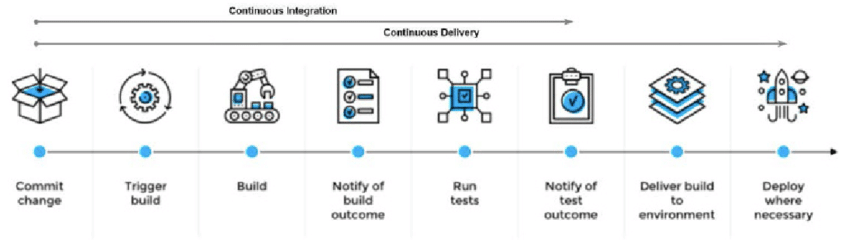

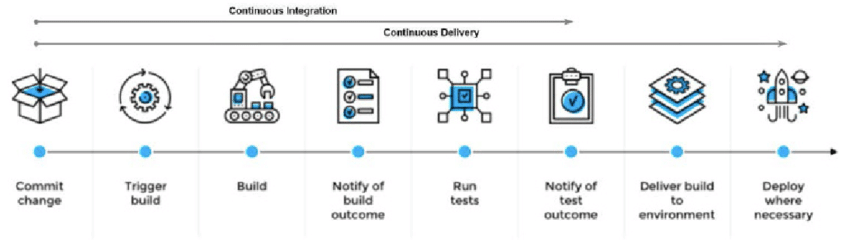

Continuous integration and delivery (CI/CD)

CI/CD practices are essential to keep development moving smoothly.

- Continuous Integration merges code changes frequently to catch issues early, reducing time spent on late-stage debugging.

- Continuous Delivery ensures that every change, once tested, can be smoothly deployed to production.

Use tools like Jenkins or Travis CI to manage these workflows effectively.

QA testing: Catching bugs before they catch you

Quality Assurance (QA) testing is crucial before launching any product. Use both manual and automated testing methods.

A manual approach helps catch specific scenarios that automated scripts might miss. Automated testing is great for repetitive tasks, making the process faster and more efficient.

Different types of tests include:

- Unit Tests: Check individual pieces of code for errors.

- Integration Tests: Make sure different components work well together.

- End-to-End Testing: Offers a complete view of user journeys from start to finish within your application.

By covering all these areas, you can ensure your software is reliable and ready for market.

How To Make The Launch Of Your Custom Financial Software A Huge Success?

Launching financial software involves more than just flipping a switch. It’s about careful planning and post-launch monitoring to ensure long-term success and avoid fleeting moments of triumph that quickly fade away.

Pre-launch preparations: Fulfilling every checkbox

As the big launch day approaches, it’s crucial to follow a comprehensive checklist to ensure a smooth and successful debut of your custom financial software. Consider the following key aspects:

- System readiness: Thoroughly test and confirm that your servers and infrastructure can handle anticipated traffic spikes, ensuring optimal performance even under high user loads.

- Documentation completion: Verify that all necessary documentation is finalized, including detailed navigational flows and maintenance pathways, which will enable operators to troubleshoot effectively regardless of shift changes or scheduling variations.

- Marketing strategy preparation: Meticulously craft your marketing approach, treating it as the metaphorical red carpet for your software’s grand entrance, complete with the fanfare it deserves to generate buzz and excitement.

- Innovative feature highlight: Develop a well-thought-out marketing plan that showcases the innovative aspects of your product, effectively communicating its unique value proposition to both consumers and stakeholders.

- ROI projection: Outline how your engagement strategies and product features are designed to lead to significant returns on investment (ROIs) within stipulated timeframes, providing a clear vision of the software’s potential impact on the business.

Rollout strategy: Gradual unveiling versus big bang

A controlled, gradual rollout might be preferable initially. This method allows you to minimize unforeseen issues by scaling the audience incrementally and making necessary adjustments on the fly.

On the other hand, a “Big Bang” launch can generate significant buzz right from the start but comes with higher risks.

Weigh the pros and cons carefully.

Consider extensive evaluation periods to fine-tune choices critically, leveraging effective strategic decisions suitable for your project’s specific dynamics.

Imagine your software as a growing organism – overcoming adversities and evolving through successive stages is key to sustained success. The goal is to achieve expansive and consequential impacts, benefitting end-users directly.

Conclusion

Developing custom financial software for fintech companies is a complex yet rewarding process.

But remember that every phase – conceptualization, design, development, and launch – is essential for creating software that stands out in the competitive fintech landscape.

With meticulous planning and thoughtful execution, your custom financial software can become a transformative tool, driving both innovation and growth in the financial technology sector.